Have you ever wondered how to measure a company’s profitability?

One key metric is Return on Sales or ROS for short. It’s simple but shows how much profit a company makes for every unit of sales.

It shows how well a company turns its sales into profit, giving a clear picture of operational efficiency. Let’s dive in!

Key Takeaways

- Understanding Return on Sales (ROS): Return on Sales (ROS) is a critical financial metric showing the profit a company makes for every unit of sales, calculated by dividing operating profit by net sales revenue. It’s key for assessing how effectively a company turns sales into profits.

- ROS the indicator of Operational Efficiency: ROS reflects a company’s skill in managing operating costs and maintaining efficiency. A higher ROS suggests better cost control and profitability from sales, crucial for growth and stability.

- Usefulness in Performance Evaluation: By tracking ROS over time and comparing it with industry peers, stakeholders can gauge a company’s financial health and operational efficiency. It helps in benchmarking and understanding market position.

- Signals to Investors and Lenders: A stable or improving ROS ratio signals to investors and lenders that the company is proficient at generating profits from its sales, indicating good financial health and operational efficiency.

- Strategies for Improving Return on Sales: Enhancing ROS might involve revising pricing strategies, cutting costs, refining production processes, and concentrating on high-margin products. These tactics are aimed at boosting profitability and market competitiveness.

Table of Contents

What is Return on Sales?

| Return on Sales (ROS) is the efficiency of a company in converting sales into profits. It is calculated by dividing operating profit by net sales revenue. |

Essentially, it shows you how much operating profit you’re making for every unit of sales revenue.

It’s a clear indicator of how well you’re managing your costs and pricing your products or services.

By keeping an eye on this key metric, you can make informed decisions to boost your bottom line and stay competitive in your industry.

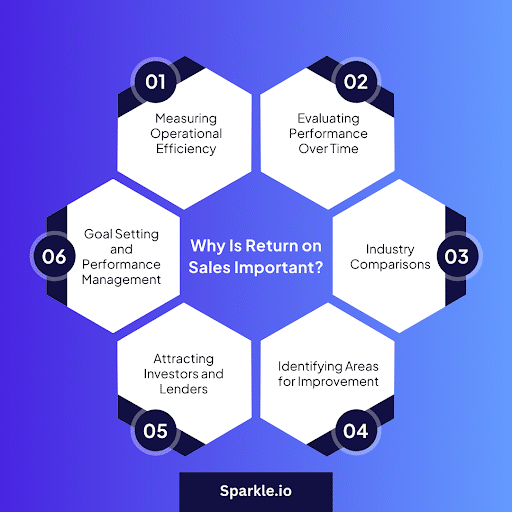

Importance of Return on Sales

Return on Sales (ROS) is a crucial financial metric that provides deep insights into a company’s operational performance and profitability. It is for managers, investors, and lenders to assess the health and efficiency of a business.

🎯Measuring Operational Efficiency

ROS is a direct reflection of how efficiently a company is managing its operations. It shows how much profit a company is generating from each dollar of sales after accounting for operating expenses. Which includes the cost of goods sold, salaries, rent, and utilities.

A high ROS indicates that a company can effectively control its costs and operate efficiently. Conversely, a low ROS may signal struggles in managing expenses.

🎯Evaluating Performance Over Time

Tracking ROS over multiple periods allows stakeholders to evaluate a company’s performance and identify trends. They can determine whether the company’s ROS is improving, deteriorating, or remaining stable.

This information can guide strategic decision-making. For example, the ROS is consistently declining. It may prompt a company to investigate the reasons behind the decline and take corrective actions.

🎯Industry Comparisons

ROS is valuable for comparing profitability within industries. However, across industries is not useful due to unique challenges and structures across various industries.

Comparing ROS to industry peers helps identify outperforming or underperforming companies, aiding investors and managers in decision-making and benchmarking.

🎯Identifying Areas for Improvement

A thorough analysis of ROS can identify areas where a company can improve its profitability. For instance, a company has a lower ROS compared to its competitors.

This may need to examine its pricing strategy, cost structure, or production processes. The company could negotiate better terms with suppliers, optimize inventory management, or streamline operations to reduce waste and boost efficiency.

🎯Attracting Investors and Lenders

ROS serves as a key indicator for investors and lenders assessing a company’s financial health and growth potential. A high and stable ROS can make a company more attractive to investors.

This is because it suggests that the company can generate substantial profits from its sales. Similarly, lenders may be more willing to provide financing to companies with strong ROS.

🎯Goal Setting and Performance Management

ROS can be used as a key performance indicator (KPI) for setting financial goals and managing performance. Managers can set ROS targets and track progress over time.

This helps align the organization around a common profitability goal. And also motivates the teams to find ways to improve sales return operational efficiency.

Return on Sales vs. Return on Investment

While Return on Sales and Return on Investment (ROI) are both profitability ratios, they measure different things:

| Metric | Return on Sales (ROS) | Return on Investment (ROI) |

| Calculation | (Operating Profit / Sales Revenue) x 100% | (Net Income / Total Capital Invested) x 100% |

| Focus | Profitability of core operations | The overall return for investors |

| Numerator | Operating Profit | Net Income |

| Denominator | Sales Revenue | Total Capital Invested |

| Perspective | Company’s operational efficiency | Investor’s perspective |

| Measures | Ability to generate profit from sales | Efficiency of capital allocation |

Return on Sales vs. Return on Equity

ROE and ROS are vital profitability ratios offering distinct views on a company’s financial performance. The table below outlines their key differences.

| Metric | Return on Equity (ROE) | Return on Sales (ROS) |

| Calculation | (Net Income / Shareholders’ Equity) x 100% | (Operating Profit / Sales Revenue) x 100% |

| Focus | Profitability from shareholders’ perspective | Operational efficiency |

| Numerator | Net Income | Operating Profit |

| Denominator | Shareholders’ Equity | Sales Revenue |

| Perspective | Shareholders’ investment returns | The company’s ability to generate profits from sales |

| Usefulness | Measuring a firm’s efficiency in generating earnings growth | Comparing the profitability of companies within the same industry |

Return on Sales vs. Profit Margin

Return on Sales is a type of profit margin. But there are other various net profit margins and margin ratios that provide different insights:

| Profit Margin | Formula | Description |

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Shows the percentage of revenue left after paying for production. |

| Operating Profit Margin (Return on Sales) | Operating Income / Revenue | Equivalent to Return on Sales (ROS). Shows the percentage of revenue left after paying operating expenses. |

| Net Profit Margin | Net Income / Revenue | Shows the percentage of total revenue left after all expenses are paid, including taxes and interest. |

How to Calculate Return on Sales

Now that we understand the significance of the Return on Sales ratio (ROS), it’s time to dive into calculating this powerful ratio. Grab your calculators, we’re about to crunch some numbers!

Formula

The formula for calculating Return on Sales (ROS) is:

| ROS = (Operating Profit / Net Sales) x 100% |

To calculate ROS, follow these simple steps:

- Gather the necessary data from your company’s income statement, including operating expenses and net sales (revenue).

- Calculate the operating profit by subtracting operating expenses from net sales.

- Divide the operating profit by net sales.

- Multiply the result by 100 to express it as a percentage.

Let’s use an example to make it clearer:

Suppose a company had net sales of $1,000,000 and operating expenses of $800,000 for the year.

Step 1:

Operating Profit = Net Sales – Operating Expenses

Operating Profit = $1,000,000 – $800,000 = $200,000

Step 2:

ROS = (Operating Profit / Net Sales) x 100%

ROS = ($200,000 / $1,000,000) x 100%

ROS = 0.2 x 100%

ROS = 20%

In this example, the company’s Return on Sales is 20%. This means that for every dollar of sales revenue, the company generates 20 cents in operating profit.

5 Methods to Increase Return on Sales

Increasing Return on Sales (ROS) is a key objective for many businesses, as it directly impacts profitability. There are several strategies a company can employ to improve its ROS ratio:

1️⃣Increase the Price of Your Product

Boosting your product’s price can directly increase your Return on Sales (ROS). However, ensure your offering justifies the higher cost. Implement strategies like premium tiers, bundling, or highlighting added value to make customers willing to pay more.

2️⃣Pursue Discounts and Cost Reductions

Cutting operational expenses is an effective way to improve ROS.

- Negotiate better supplier rates

- Optimize inventory levels

- Streamline production processes

- Invest in automation

Continuously identify areas for cost savings without compromising quality or customer experience.

3️⃣Strip Back How You Produce or Sell Your Product

Evaluate your product features and sales processes. Eliminate unnecessary components or activities that don’t add value. Focus on the core offerings that differentiate your business. Implement systems and training to enhance efficiency and productivity.

4️⃣Diversify Your Product or Service Offerings

Expand your product line with complementary offerings. This will attract new customers and increase the average order value. However, exercise caution and conduct thorough research before diversifying to ensure profitability and alignment with your target market.

5️⃣Focus on High-Margin Products or Services

Analyze your portfolio and prioritize high-margin products or services. Tailor your offerings to niche segments with a higher willingness to pay premium prices. Continuously monitor and adjust your product mix based on market trends and profitability data.

FAQs

👉What is a good Return on Sales ratio?

While it varies by industry, a ROS of 5% or higher is generally considered good, and 10% or more is exceptional. However, it’s important to compare a company’s ROS to its industry average for the most relevant benchmark.

👉How does Return on Sales differ from other profitability ratios?

Return on Sales specifically measures operating profit as a percentage of sales revenue, focusing on the profitability of a company’s core operations. Other ratios, like Return on Investment (ROI) and Return on Equity (ROE), measure different aspects of profitability.

👉What are some strategies to increase Return on Sales?

Companies can improve their ROS by increasing prices, reducing costs, streamlining operations, diversifying product offerings, and focusing on high-margin products or services.

👉Is Return on Sales the same as Operating Profit Margin?

Yes, Return on Sales and Operating Profit Margin are essentially the same metric. They both calculate profit margin as operating profit as a percentage of sales revenue.

👉Why is Return on Sales important for investors?

Investors use ROS to assess a company’s financial health and profitability compared to its peers. A high and stable ROS can make a company more attractive to investors, as it suggests the company is efficiently generating profits from its sales.

Path to Profitability

Return on Sales is your guiding light to operational efficiency and profitability. Mastering this metric empowers you to make informed decisions, optimize processes, and maximize revenue.

Let’s recap the key takeaways that will give you the ROS edge:

📌ROS measures a company’s ability to convert sale interest expenses to profits.

📌Monitoring and improving ROS enables better decision-making.

📌Use ROS with other metrics for comprehensive evaluation.

📌Enhancing ROS drives sales process optimization and revenue growth.

Embrace the power of ROS, stay agile, and watch your business soar to new heights of success.

Reference:

- Return on Sales: ROS and ROI: Analyzing the Relationship, Faster Capital

- Return on Sales vs. Operating Margin: What’s the Difference?, Investopedia

- Return on Equity (ROE), Corporate Finance Institute